What does $100k mean to you?

Last week someone on my email list threatened to report me for false advertising. Yikes! 😳

A few years ago, I would have totally panicked about a comment like that… but instead, I couldn’t wait to tell Eric and we had a big laugh about it!

Wanna know what I said that triggered someone into sending me hate mail?

Well, it was an email about a client result that sounded too good to be true, so someone decided it couldn’t possibly be true.

Here’s what I sent:

**********************

Big money can be a funny thing - we can love it or hate it.

When you’re in $100k of debt, like I was, the thought of $100k can make you feel sick because all you see is your debt.

Toni felt the same way too a year ago.

When she first joined my program, she was in $100k of debt and she hated thinking about money and opening her bills.

As you’ve probably heard, Toni was able to totally shift her energy around money and six months later, her debt was gone!

Now, that’s an amazing outcome and T...

How Toni Cleared $100k of Debt in 6 Months

Meet Toni. She’s not a celebrity, not famous, but she’s got an incredible story worth sharing. She managed to clear $100k of credit card debt (and you can too).

We started together about 6 months ago, and Toni was completely overwhelmed.

The anxiety, the guilt, feeling like a failure, wondering how she’d ever get a handle on the debt.

Even though she had the option of selling her house, she knew she had to address the underlying issue that had gotten her there in the first place, otherwise, it’d just happen again- except this time she wouldn’t have a house to bail herself out with.

She’d done course after course and spent a whole lot of money searching for that magic pill to help her get out of her situation. But it was only when she enrolled in my Debt To Diamonds course that she finally got her money mindset right- and the numbers followed.

“We met on a cruise a couple of years ago and I thought I could work with you. It was your energy that attracted me to you - I’d seen you po...

Where Your Money Blocks Come From

The first time I felt shame about money was when I was 4 years old, and it happened somewhere totally unexpected.

I used to have a friend at school who got free snacks because her Mum volunteered at the school canteen and we’d often go together and get something tasty. One day, I went without my friend and asked for a strawberry frozen yoghurt (my favourite) and her Mum told me I’d have to start paying for my food.

I hadn’t known, of course, that she’d been paying for those ‘free’ snacks behind the scenes all along. What I did know was that I stood there, 4 years old, suddenly aware that I needed money and deeply humiliated by not having any.

I started looking around at the other kids and comparing myself. The rich kids had money for the canteen and Reebok shoes. Their parents were doctors or lawyers. I wasn’t like them. The shame I felt stopped me from telling my parents about what had happened and though I didn’t realise it at the time, the intensity ended up shaping my relatio...

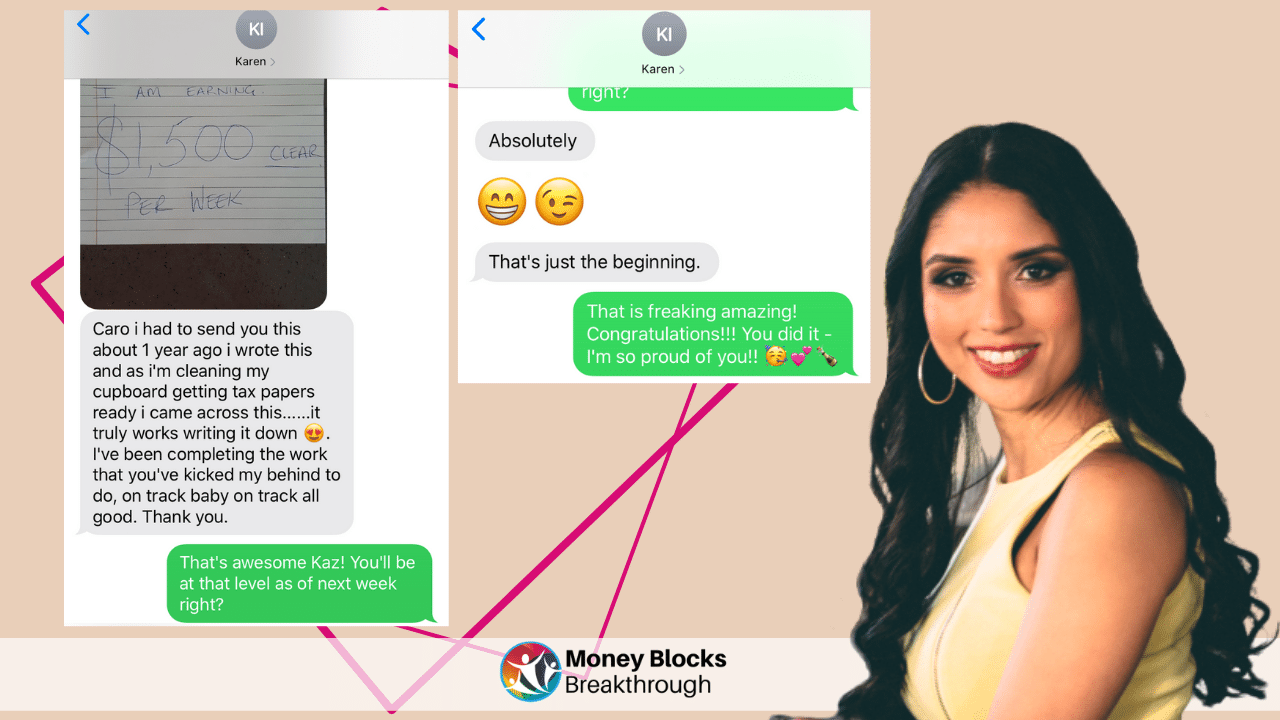

Client Results: How Karen made an extra $4k per month

Think it's possible to make an extra $4K per month by writing it on a slip of paper?

For most people, it isn't. They write out the same goals year after year, or make vision boards... and nothing changes.

But it just happened to my client, Karen.

See, Karen recently stumbled across a goal she wrote a year ago while she was doing tax prep.

“I am earning fifteen hundred dollars per week,” she wrote.

Karen had forgotten all about this slip of paper.

Like a lot of people, Karen had set goals like this in the past with no luck. She felt stuck because she didn’t have the time to work on her goals or get extra support.

I'm sure you've heard that famous definition of insanity: doing the same thing over and over and expecting a different result.

Karen realized that's what she was doing and she decided to try a different approach. She followed up on a conversation we had two years ago and ended up joining my Money Blocks Breakthrough Program.

Karen wanted to make more money, but with...

The Incorrect Assumption People Make About Debt

There’s one assumption people make about debt that’s WRONG.

People get this wrong whether they’re $5,000 or $100,000 in debt.

And it keeps them stuck in a paralysing cycle.

It's exactly what happened to my client, Toni.

Toni felt like she was drowning in debt and she couldn't face it anymore.

That's when she hopped on my 5 day Money Blocks Breakthrough Challenge and reached out to me for help.

Like a lot of people, Toni had assumed that to get out of debt, you need to make more money.

She'd been trying this for years and was getting nowhere.

Sure, you need money coming in to pay off a debt balance. But that’s treating the symptom.

It’s like putting cream on a rash when you don’t know the cause.

It turns out you’re allergic to canned tomatoes, but you don’t know that. So you keep eating tomatoes and keep using your rash cream.

You get temporary relief with each outbreak, but the problem never goes away.

You might struggle with this for years when a simple allergy test co...

How I Got Out of $97,000 of Personal Debt

Today I want to share my story about how I got out of $97,000 of credit card debt.

Yep… $97,000.

I felt inspired to share this because a friend of mine told me yesterday that she thought I’d had a perfect life and I’d never struggled with money.

Can you believe it?

If that’s what my friend thought, then it means I’ve been pretty darn good at keeping my debt a secret… and I did it mostly because I was so embarrassed about it.

I’ve been keeping it a secret when in fact, it’s the whole reason I went looking for help and stumbled across money blocks.

Finding and releasing my money blocks changed my entire money story and also allowed me to quit my corporate job and create my dream business.

I shared a video today in my private Facebook group about my personal story and why I’m so passionate about showing business owners how to fix their relationship with money.

I wanted you to see it too, even if you’re not in my Facebook group.

Click on the video above to watch it.

And if my sto...

How To Break The Cycle of Being Bad With Money

When you lose sight of how much you spend, it is really easy for small things to add up and get out of control, keeping you stuck in that feeling that you’re “Just bad with money.”

Get back on top of your money by increasing the visibility of your expenses!

Let’s look at how it works…

Tracking Allows You to Identify the Problem and Manage It

When you pay attention to what you spend and you keep those numbers visible in the front of your mind, then you can actually take practical action to manage your money game.

In the Money Mindset Bootcamp that I run, one of the big things that we do is to look at your money in real terms. We gather the data of your income and spending habits, and from there we set what your budget is.

The first step is to review your bank statements and bills and do the math to get an idea of roughly what it is that you spend and where. (Some people don’t even realize they spend $2,000 on groceries, when half of that would be enough for their househo...

Making More Money Will NOT Clear Your Money Blocks

Money blocks are self-limiting beliefs around your income and income goals. What you may not realize, however, is that simply making more money does not clear your money blocks. And until you do clear your money blocks, your money problems may only get worse.

More Money, More Problems

There's a common misconception out there that making money can solve all of your problems. As I’ve learned from my own experience, and see all the time in the lives of our clients here at Money Mindset Accelerator, money problems don’t go away until money blocks are cleared.

As you make more money and you become more successful, everything that you do gets magnified. If you haven't dealt with your money blocks, they’ll get magnified too, and you'll find even bigger ways to lose money and get yourself into financial trouble.

For example, no matter how much you earn, you can always spend more. And if you have fear, anxiety, panic or guilt around money, those feelings will follow you and magnify a...

Make More Money and Give More of Your Time

What Is The The Law Of Reciprocity?

At the most basic level, we could use the entrepreneur example: you've got something to sell, products or services, and you will provide those in exchange for a fee.

That's kind of basic giving and receiving, but I believe there is a much broader application of that as well, in business, and certainly in other aspects of life.

Some of the mentors that I've worked with, like Akbar Sheikh and Julie Tingen who both use the tagline “make more so you can give more” believe that we, as entrepreneurs, can make as much money as we can so that we can ultimately give a lot more back.

Do You Feel That Making More Money Is Greedy?

Some people feel that making a lot of money is really greedy. If that applies to you I'd urge you to challenge yourself look for the belief that’s causing that particular money block.

There's no reason why you have to be greedy if you make a lot of money. My view is that you should make enough as you need to fund the lif...

Understanding Money Blocks

I’ve heard it said before that comprehension starts and ends at the point of articulation. That is, how we talk about what we experience, the language we use to describe it, shapes our understanding of that experience.

Quite often when people feel “stuck,” it’s for a lack of words to explain what's going on. We simply just experience something, but we can't really explain why we're stuck, and for that reason, we can’t understand it, and for that reason, we can’t get out of it.

While true in all areas of life, today we’re looking at how working with a money vocabulary can help you improve your life financially.

Specifically, we’re looking at money blocks.

What Are Money Blocks?

Money blocks are self-limiting beliefs around money. They affect people in three main ways:

1. Money Creation Money Blocks

People with money blocks centered on money creation struggle to create money and create wealth. These people want to earn more, and try to earn more, but seem to get stuck earn...